Calculate ebitda margin

This is a measure of profitability. We can represent contribution margin in percentage as well.

How To Build And Use Ebitda Bridges Waterfalls By Ramin Zacharia Medium

Unit contribution margin per unit denotes the profit potential of a product or activity from the.

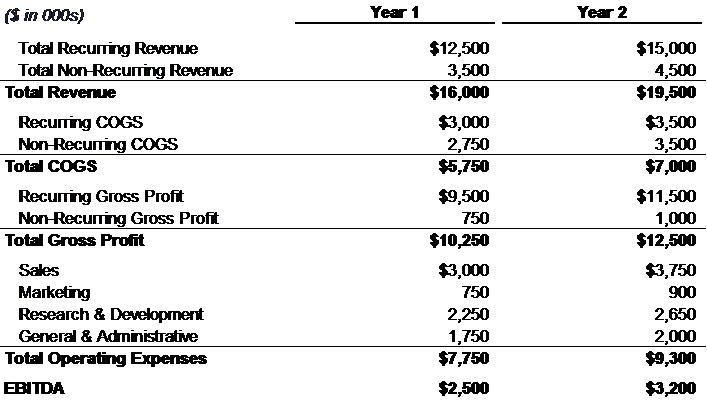

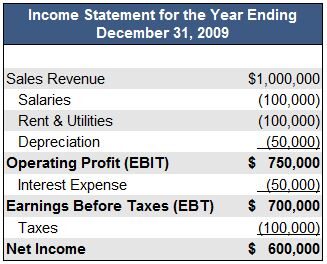

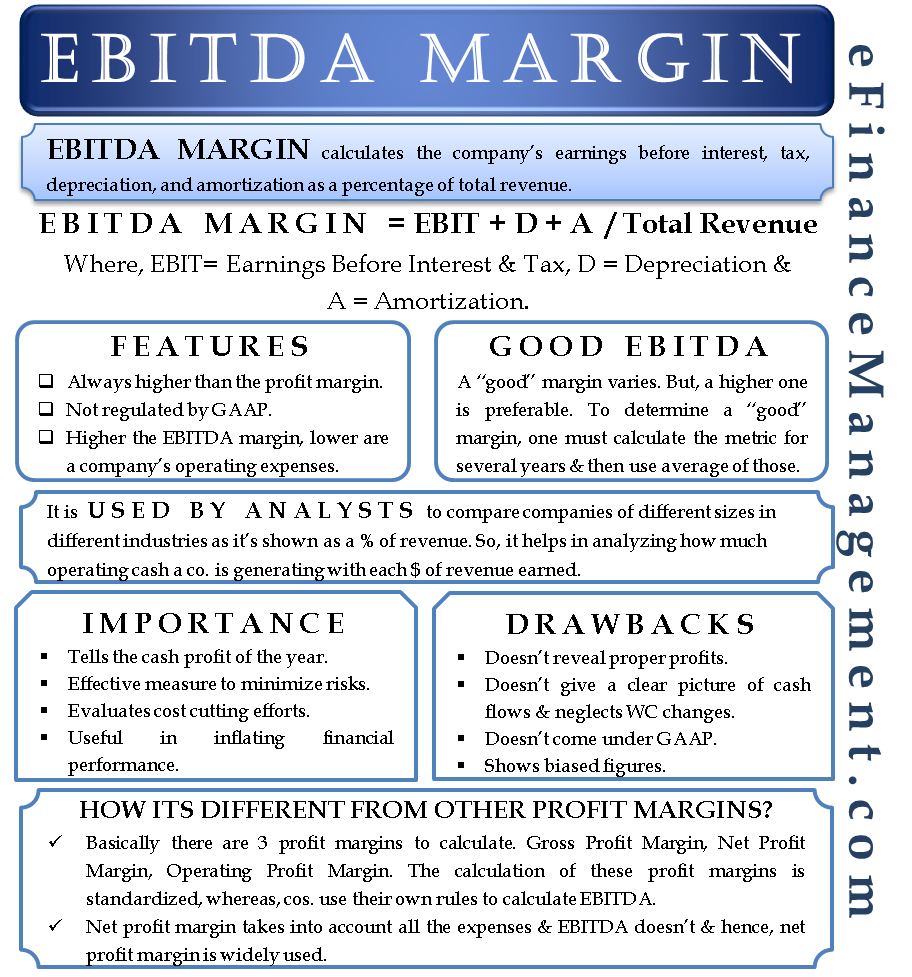

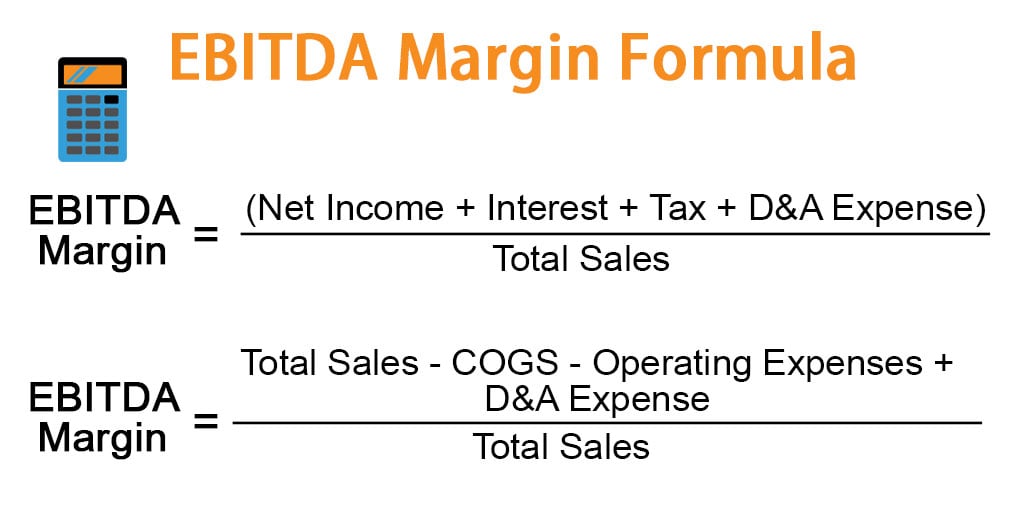

. How to Calculate EBITDA Margin. EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. If we do not have enough cash to fund operations we are in a net cash burn situation.

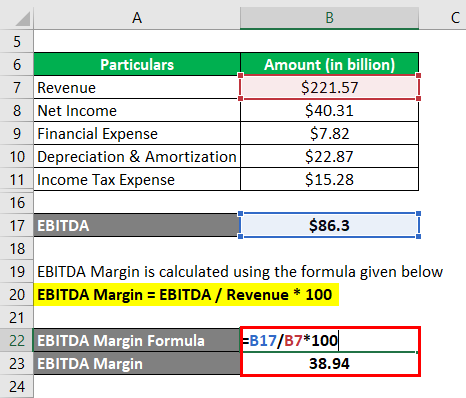

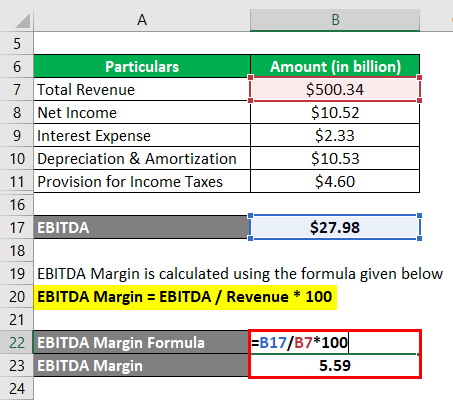

The goal in doing so is to provide enhanced transparency into the. Margin ratios represent the companys ability to convert sales into profits at various degrees of measurement. Let us take another real-life example of Apple Inc.

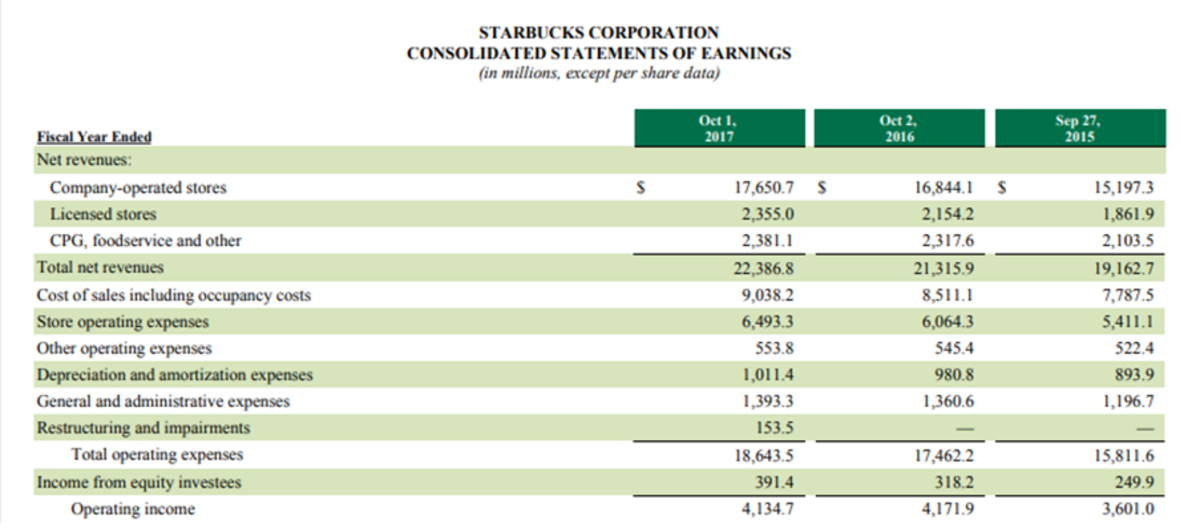

Therefore Bombardier Incs made EBITDA of 1388 million during the year. If your business has a larger margin than another it is likely a professional buyer. The following chart shows how to calculate Starbucks EM for fiscal.

Defined Contribution Plan Example. Consider the following facts from the 2017 annual report of Starbucks. How to Calculate our Cash Burn Rate.

Gross Margin 38. It is equal to earnings before interest tax depreciation and amortization EBITDA. Based on the latest annual report for the year ending on September 29 2018 the information is available.

Operating Cash Flow Margin. The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. For example an average EBITDAsales margin for the advertising industry is 1739 meaning that EBITDA is 1739 of sales.

An example will serve to illustrate how to calculate the EBITDA margin. By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. In this scenario we will calculate our net cash burn rate and our gross cash burn rate.

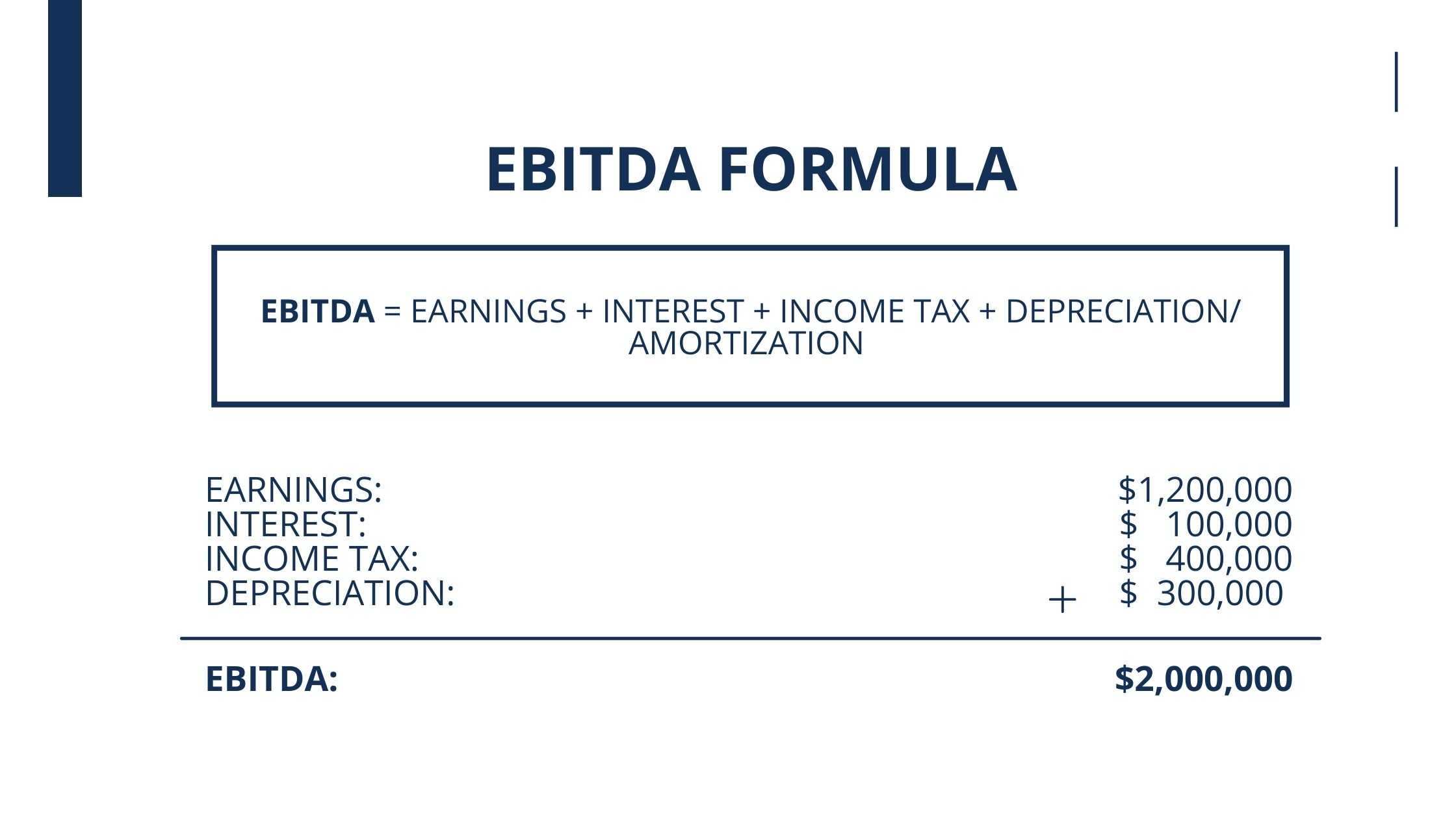

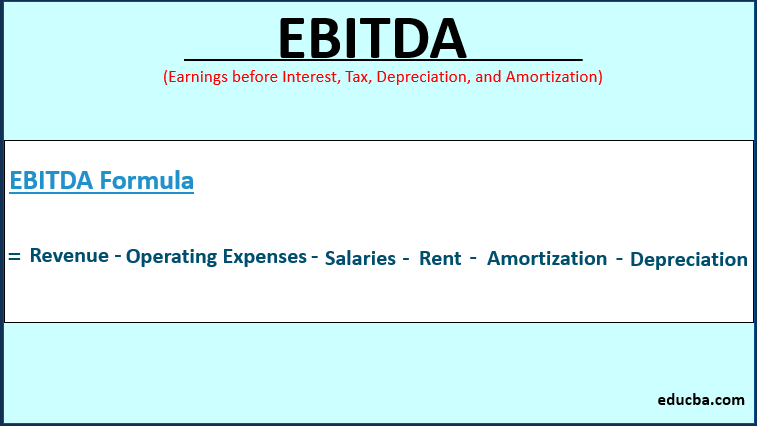

An operating cash flow margin is a measure of the money a company generates from its core operations per dollar of sales. The acronym EBITDA stands for earnings before interest taxes depreciation and amortization. It represents the profitability of a company before taking into account non.

There are two main ways to calculate burn rate as mentioned above. Gross Margin Formula Example 2. Here we discuss the formula to calculate Contribution Margin and practical examples and excel templates.

We would like to show you a description here but the site wont allow us. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. EBITDA Formula Example 3.

EBITDA is a useful metric for understanding a businesss ability to generate cash flow for its owners. Examples are gross profit margin. To know if an EBITDA multiple is good you must look at it compared to other similar types of businesses.

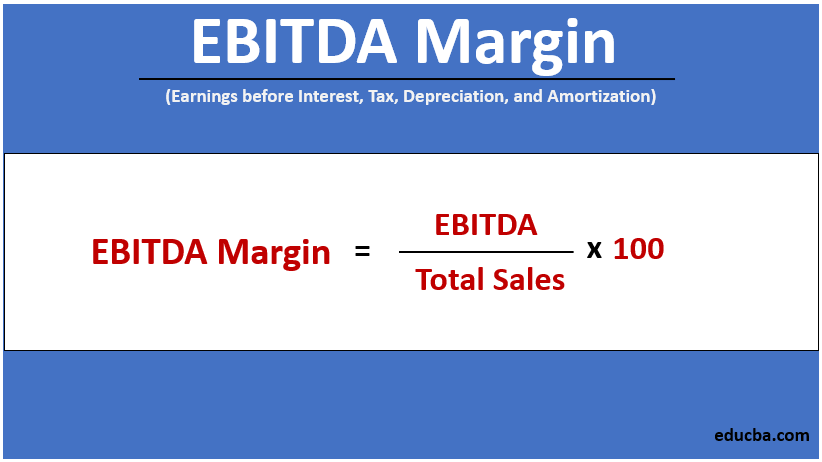

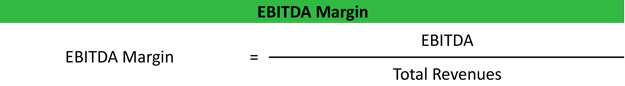

This has been a guide to the Contribution Margin and its meaning. EBITDA margin EBITDA Total Revenue. The practice of companies disclosing non-GAAP earnings to offer more insight into their recent operational performance and financial position has become rather common in recent years.

How to Calculate EBITDA. As you can see Christies operating income is 360000 Net sales all operating expenses. EBITDA 1388 million.

EBITDA 318 721 77 272. This means that 64 cents on every dollar of. EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization.

The formula for an EBITDA margin is as follows. According to our formula Christies operating margin 36. Alternatively it is known as the contribution to sales ratio or Profit Volume ratio.

EBITDA stands for E arnings B efore I nterest T axes D epreciation and A mortization. For the year ended. A higher EBITDAsales multiple than average means a company is more profitable.

You may also look at the following articles to enhance your financial skills. The operating cash flow can be found on the. Instead we can calculate our gross cash runway.

Here is how Christie would calculate her operating margin.

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula And Calculator

Ebitda Margin Formula Meaning Interpretation With Examples

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margins What Every Small Company Owner Needs To Know

Ebitda Margin Definition Example Investinganswers

Ebitda Margin Formula And Calculator

How To Calculate Ebitda Margin

Ebitda Types And Components Examples And Advantages Of Ebitda

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Formula Definition And Explanation

How Do I Calculate An Ebitda Margin Using Excel

Ebitda Margin Features Importance Drawbacks Other Profit Margins

Ebitda Margin Formula Example And Calculator With Excel Template

What Is An Ebitda Margin Examples And How To Calculate Thestreet